Bitcoin Surges to $119K Amid U.S. Government Shutdown

-

![Avatar]() By ryker

By ryker

- October 02, 2025

- 4 min read

- 0 Comments

Bitcoin’s price has suddenly gone through the roof and passed $119,000. It is now at its highest level in over two months. The ongoing U.S. government shutdown has caused a lot of volatility in the world’s financial markets, which is why there is a rally right now.

How the U.S. government shutdown has changed things

Since October 1, 2025, when the U.S. government shut down, many federal services have been stopped and important economic reports have been delayed. Analysts think that this uncertainty might make the Federal Reserve think about lowering interest rates, which could make the market more liquid. Investors are looking for assets that are less tied to traditional financial systems, which has been good for Bitcoin.

In past shutdowns, markets often shrugged them off, but this time feels different. The scale of data disruption is larger. For example, the Bureau of Labor Statistics may delay its nonfarm payrolls report and unemployment claims data because of staffing issues. Without those economic signals, the Fed will have less transparency on inflation and labor trends, making its policy moves riskier. Meanwhile, credit default swap spreads on U.S. sovereign debt have widened, reflecting increased perceived risk in U.S. government obligations.

Also, the political dysfunction sends a signal to global investors: when America can’t even fund its own government, confidence weakens. The U.S. dollar, already under pressure, could face further depreciation, making alternative assets more attractive.

How the Market Reacted and What Analysts Thought

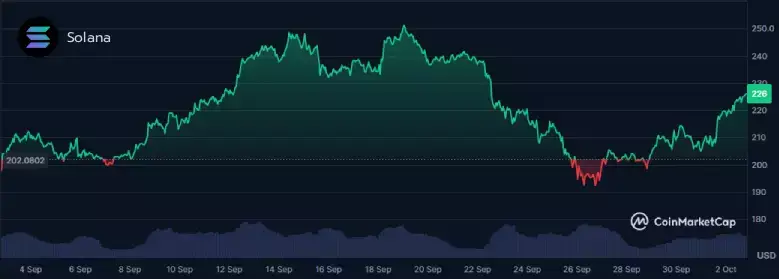

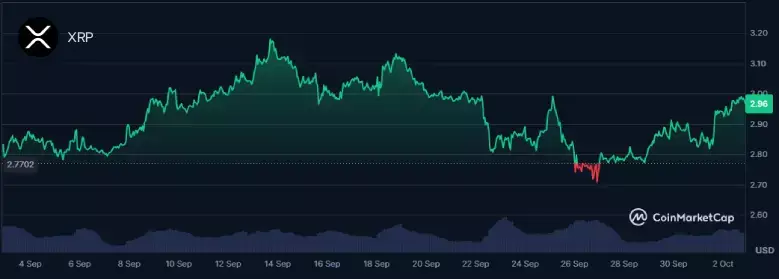

Along with Bitcoin’s price rise, the cryptocurrency market as a whole has also gone up. The price of Ethereum (ETH) has also gone up a lot, reaching over $4,300. The total value of all cryptocurrencies on the market has gone up by 4.2% thanks to altcoins like XRP and Solana (SOL) doing the same.

But there’s nuance. Citigroup recently adjusted its outlook: it raised its year-end target for Ethereum to $4,500, while slightly trimming its upper bound for Bitcoin to $133,000, citing headwinds from a strong U.S. dollar. Some analysts see the recent rally as a liquidity impulse. With less data and more ambiguity, risk assets like crypto are getting extra flow.

Others also warn: although many altcoins are participating, the rally is still heavily tilted toward Bitcoin and Ethereum. If sentiment weakens or if the shutdown drags on, capital might rotate back to safer assets.

Another angle: the delays in regulatory and institutional moves. The SEC has limited staff during the shutdown, so new spot crypto ETFs or approvals might be postponed. That could slow the inflow of institutional capital in the short term, even if sentiment remains bullish.

What Bitcoin Means for the Economy Right Now

Bitcoin’s recent performance shows how important it is becoming as a hedge against changes in traditional financial markets. Cryptocurrencies like Bitcoin are an alternative way to store value while central banks around the world deal with problems like inflation and unstable economies.

One policy development adding weight: In March 2025, a U.S. executive order established a Strategic Bitcoin Reserve for the federal government. Under this plan, the U.S. could hold as much as approximately 198,000 BTC in its reserves. The idea is controversial. Critics question the legality, volatility, and precedent, but proponents see this as a signal: in the future, nations may include digital assets in their sovereign reserves.

This reserve plan also underscores how governments are gradually acknowledging crypto’s role in the financial system. As macro risk rises, Bitcoin could shift further from niche asset status to strategic asset.

Also, patterns between gold and Bitcoin are worth watching. Historically, when gold momentum stalls, Bitcoin tends to break out and vice versa. Some analysts believe gold is showing signs of fatigue, which may open the door for Bitcoin to push even higher.

Where Risks Lurk

It’s not all smooth sailing. Here are key risks to keep in mind:

- If the shutdown lasts long, the economic damage may accumulate. The U.S. could lose approximately $15 billion in GDP each week of shutdown. That deepens macro stress and could spook markets.

- Delays in critical data make it harder to validate the rally’s strength. The Fed may misjudge inflation or labor trends and act suboptimally.

- If the U.S. dollar reverses course and strengthens, that could undercut Bitcoin’s appeal.

- Regulatory or policy surprises could derail sentiment, especially if the SEC is forced to rollback or freeze approvals.

- The Uptober effect, known for October strength for Bitcoin, is a seasonal trend but not guaranteed. Momentum can change quickly in crypto.

A Look Ahead

Even though the market is currently favorable for Bitcoin, experts warn that things could change at any time. The government shutdown that is still going on and its effects on the economy could continue to change the way markets work in the coming weeks. When making investment decisions, investors should stay up to date on the market and think about the economy as a whole.

If economic data remains absent or contradictory, expect volatility. A 25 basis point rate cut in October is nearly priced in by many analysts, but if inflation surprises or the Fed turns hawkish again, crypto could see a pullback. Some traders will watch gold’s momentum, dollar strength, and the timing of the shutdown’s end for clues.

One more point: if the SEC resumes operations fully and spot crypto ETFs or institutional flows accelerate, that could add fuel to this rally. But for now, the backdrop is murky.

-

0

-

0

-

0

-

0

-

0

-

0

-

0

-

0

- Previous Article Why AI Agents Could Change Everything Faster Than You Think

- Next Article GTA 6: The Tech Redefining Open World Gaming